About Mutual Funds

- About Mutual Funds

- Categorisation of Mutual Funds

- About SIP

- Taxation on Capital Gains

- Past SIP Performance

- Latest NAV

- SWP Calculator

- Scheme Performance

- Dividends Announced

- Fund Factsheets

Our Services

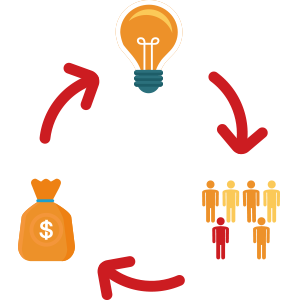

What is Mutual Fund?

A mutual fund is simply a financial intermediary that allows a group of investors to pool their money together with a predetermined investment objective. The money collected is managed by Asset Management companies (AMC). The mutual fund will have a professional fund manager who is responsible for investing the pooled money into specific securities (stocks, bonds, Gold etc). Mutual funds are one of the best investments ever created due to cost efficiency, ease of investing, professional management, transparency & diversification.

Advantages of Mutual Fund:

Professional Fund Management: Managed by professional fund managers who are highly qualified and experienced and have strong research teams.

Diversification: Mutual funds aim to invest across different asset classes like Equity, Debt and commodities allowing you to diversify the risks.

Convenience and Flexibility: You can easily invest and withdraw in any amounts and choose to invest affordable, calculated amounts systematically. There is no lock in apart from close ended and tax saver mutual funds.

Transparent and Well Regulated: The rules and regulations are continuously reviewed and defined by SEBI from time to time in order to protect the interest of investors.